Most rebates and credits are administered independently of each other, and can be stacked for potentially significant savings.

Contact the experts at Dinomite Heating & Cooling for assistance with identifying HVAC upgrades and replacements that qualify for the below rebates and tax credits.

-

IRS Section 25C Tax Credit – Energy Efficient Home Improvement Tax Credit

The U.S. Government passed the Inflation Reduction Act of 2022 which includes a number of tax credits for the installation of heating and cooling products that meet or exceed the highest tier established by the Consortium for Energy Efficiency (CEE). The ENERGY STAR certification process is consistent with the CEE highest tier requirement and is a great reference for understanding equipment eligibility.

ffective Jan. 1, 2023, a tax credit equal to 30% of installation costs for qualifying high-efficiency products, up to a maximum of $600 for air conditioners, $600 for furnaces, $600 for supporting electrical upgrades and a maximum of $2,000 for heat pumps. By taking advantage of the available tax credits for qualifying high-efficiency air conditioners, furnaces, and/or electrical upgrades along with the installation of a high-efficiency heat pump, a homeowner could claim up to $3,200 in credits annually.

-

Available Section 25C Tax Credits

- Up to $2,000 for the installation of ENERGY STAR-certified heat pumps (≥15.2 SEER2)

- Up to $600 for the installation of ENERGY STAR-certified split air conditioners (≥16 SEER2)

- Up to $600 for the installation of ENERGY STAR-certified packaged air conditioners (≥15.2 SEER2)

- Up to $600 for the installation of ENERGY STAR-certified gas furnaces with AFUE > 97%

- Up to $600 for electrical upgrades enabling the installation of qualified energy improvements

Additional information about the available Federal tax credits and qualifying equipment is available from ENERGY STAR: https://www.energystar.gov/about/federal_tax_credits

Consult with your tax professional to verify individual eligibility based on your particular tax situation.

Please Note: The above information has been gathered from ENERGY STAR, press releases from Carrier Corporation and other publicly released information and has not been independently verified against IRS requirements.

-

Duke Energy Carolinas Smart Saver Rebates

Duke Energy Carolinas customers are eligible for rebates when replacing non-operational HVAC systems, and for the early replacement of operational HVAC systems with modern, higher-efficiency systems.

Non-operational equipment is classified as equipment with a failed compressor, large refrigerant leak, cracked heat exchanger or when the age of the system prevents repair due to parts non-availability.

Duke Energy Smart Saver Rebate Eligibility Requirements:

Duke Energy utility rebates are only available to Duke Energy residential electric service customers residing in single-family homes, condominiums, mobile homes on permanent foundations, townhomes and duplexes. Rebates are only available when the new HVAC equipment is installed by a Duke Smart Saver participating contractor such as Dinomite Heating & Cooling. The new equipment must meet the SEER(2)/EER(2)/HSPF(2) requirements listed in the tables below.

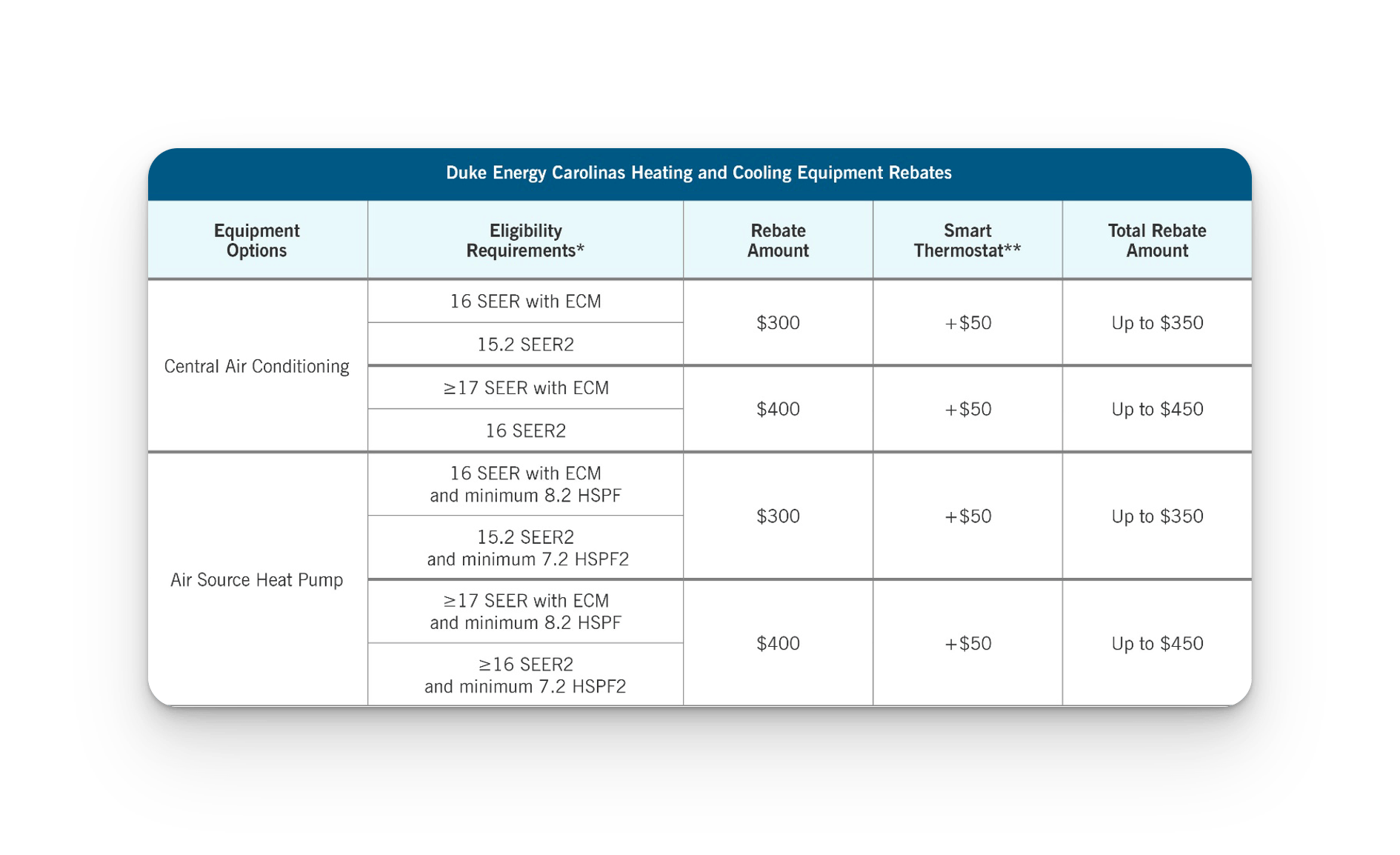

Available rebates for non-operational HVAC system replacement:

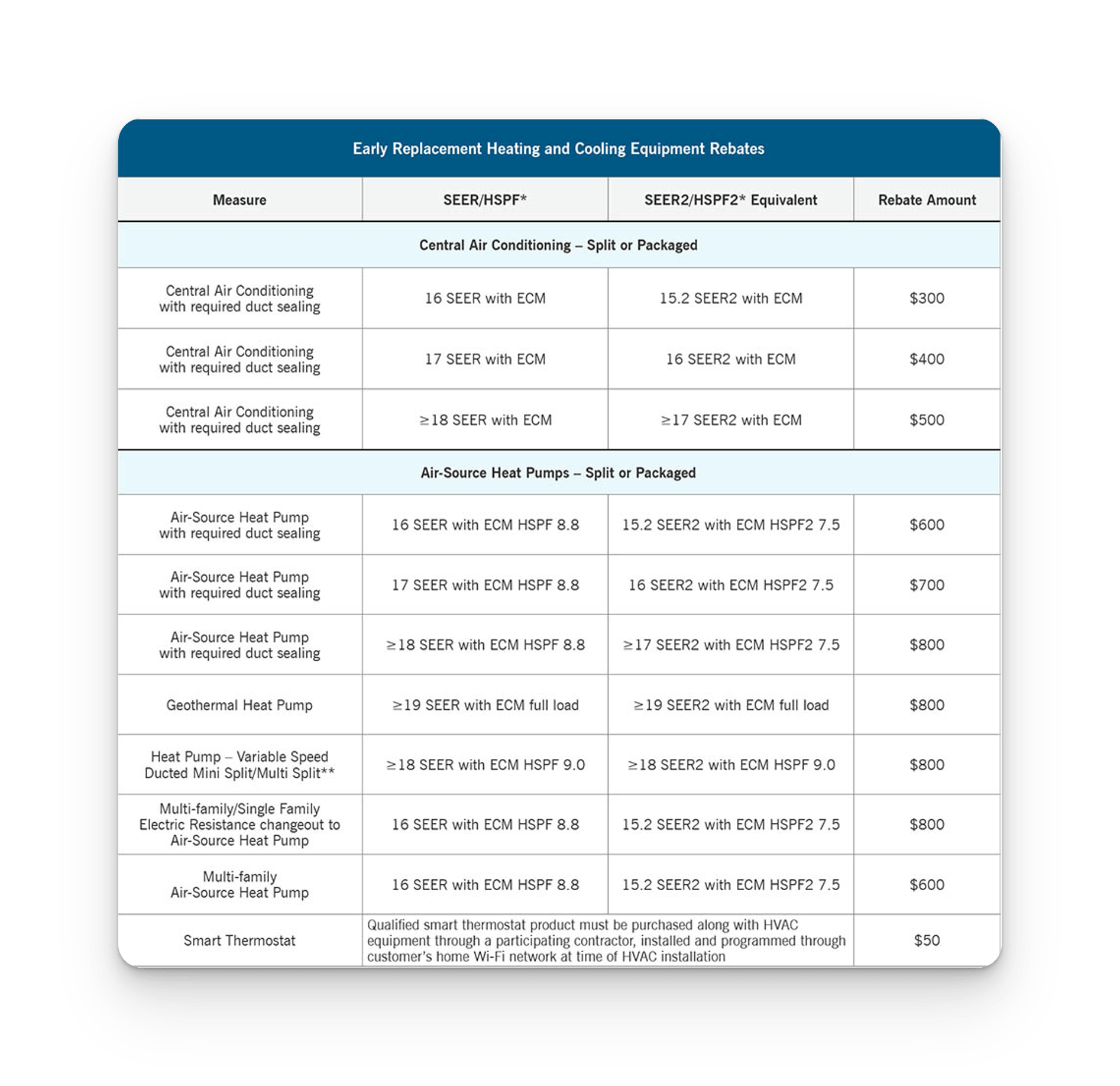

Available rebates for early replacement of operational HVAC systems:

Additional information is available at: https://www.duke-energy.com/home/products/smart-saver/hvac-install

-

Piedmont Natural Gas Rebate

Piedmont Natural Gas customers are eligible to request a rebate after the upgrade of an existing gas furnace to a qualifying high-efficiency model of 90% AFUE or higher. Customer must have proof of installation by a licensed contractor such as Dinomite Heating & Cooling.

AFUE Rating for Gas Furnace Rebate Amount

90 to 94.9 percent $175

95 to 97.9 percent $225

98 percent and higher $325

Eligibility Requirements:

- Rebates available only to Piedmont Natural Gas residential customers in North Carolina.

- Residential rebates only apply to existing residential customers that are served under the Residential Service Rate Schedule 101.

- Rebates are only available for the replacement of existing natural gas equipment with new qualifying high-efficiency equipment.

- Rebates are not available for the equipment replacement of an alternative fuel source such as electricity and propane.

- Equipment must be installed at the house where the gas account is located.

- A natural gas furnace is required for the smart thermostat rebate.

- Applications must be submitted within 120 days after equipment installation.

Online Piedmont Natural Gas Rebate Submission: https://piedmontng.ri-app.com/

Mail-In Piedmont Natural Gas Rebate Submission: https://www.duke-energy.com/-/media/pdfs/png/home/save-energy-money/png-ee-rebate-form-rhvacwh.pdf?rev=79f6354c4a8946c8bb706abbbdfebaca&webSyncID=0d7ee08a-9ac6-6439-41ae-ac3ac3227192&sessionGUID=ad44094d-bab7-5ed9-0358-710ed635c099

-

City of High Point Electric Rebates

Residential customers whose electric service is provided by the City of High Point are eligible to receive a rebate up to the amount of $400 per 16 SEER heat pump unit.

| Heat Pump SEER | Existing Home Rebate |

|---|---|

| 16 – 17.9 | $300 |

| 18+ | $400 |

Program Requirements

- Minimum capacity of 1 ton and maximum capacity of 5 tons

- Minimum efficiency rating of 16 SEER (Seasonal Energy Efficiency Ratio)

- Multiple units installed at one location/by one owner are each eligible

- Both package heat pump systems and split-system heat pumps are eligible

- Authorized/licensed HVAC contractor must obtain the required permits

- Prior to issuing the rebate, the City of High Point requires that the installation be inspected by a City Building Code Inspector

Additional information available at: https://www.highpointnc.gov/531/Appliance-Rebates

Subject to Change: The above rebates and qualification criteria are subject to change without notice by the governing bodies for those specific rebates and credits. Please perform your own research to verify current qualification criteria and the current value of rebates or credits.